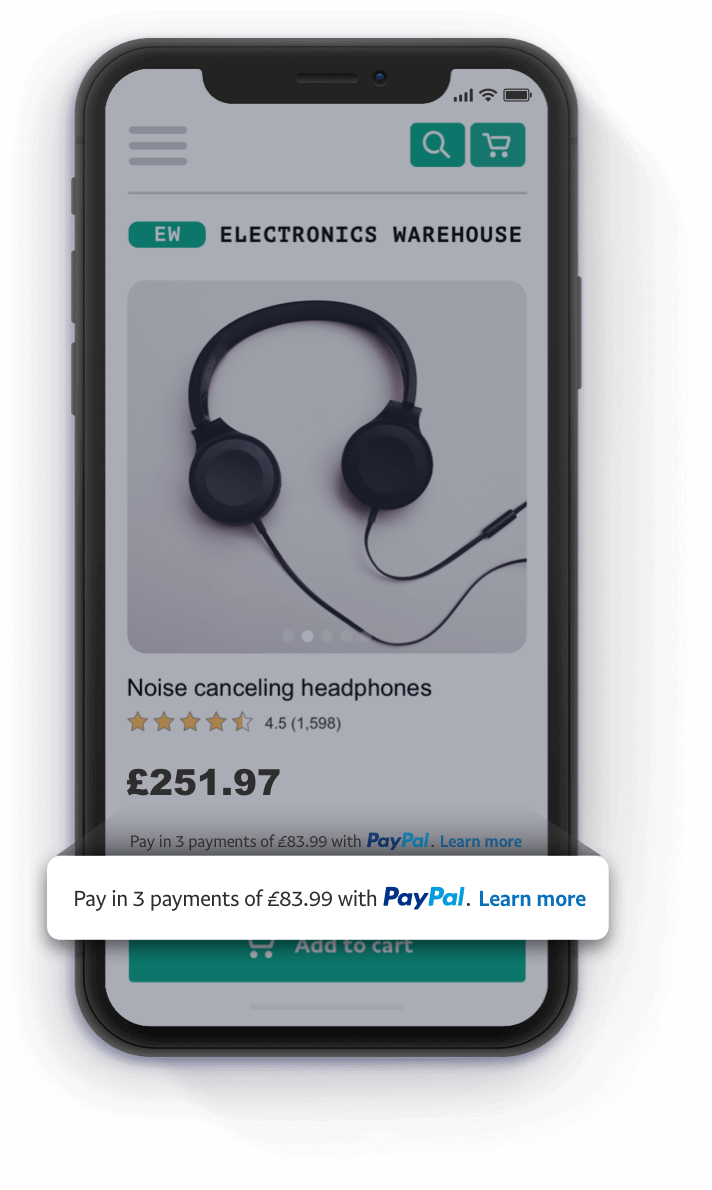

Give your travel business a competitive advantage and find out more about what PayPal offers at: /uk/travel-industry. The BNPL solution is also included in PayPal’s enterprise rate, at no extra cost to new or existing consumers. With PayPal Pay Later, messaging is easy to integrate, without needing complex coding.

53% of millennial and Gen Z consumers have abandoned a purchase when BNPL messaging was visible while they were shopping. It’s also important that BNPL messaging is visible across your website during the entire buying journey and not just on the checkout page. Nearly half of millennial and Gen Z consumers have abandoned their purchase when BNPL wasn’t availableįor the travel sector, abandonment rates are some of the highest in e-commerce 12, so adopting BNPL on your retail travel site could significantly reduce cart abandonment. This is especially true for millennials and Gen Z consumers, who constitute the largest group of BNPL users. With PayPal Pay Later, travel retailers get paid fully upfront, even when a customer opts to pay by instalments.īNPL’s monumental global growth signals that more consumers are choosing the likes of PayPal’s Pay Later as a preferred payment method. Deferred payments are also of lower risk to travel businesses. Increases in AOV could significantly benefit businesses in the still-recovering travel sector. This increase in AOV includes the travel sector as customers can invest in better amenities and services thanks to deferred costs. Nearly 70% of consumers say that BNPL enables them to invest in better products 9, as the heavier upfront costs can be broken into smaller, more budget-friendly installments PayPal’s global Pay Later solutions have seen our business partners enjoy over twice the AOV gains compared to payments made with the standard PayPal wallet. 3 As the preference for payment flexibility grows globally, travel companies offering BNPL are putting themselves at the forefront of consumer expectations. The ability to pay later appealed to a quarter of travellers worldwide in 2021 who said BNPL options were an important factor when booking a service related to the trip. With BNPL services like PayPal Pay Later, your customers can invest in quality holiday experiences without being deterred by the strain of a large lump-sum payment. Quarter of travellers worldwide in 2021 said BNPL options were an important factor when booking a service related to the trip This makes BNPL very relevant in the retail travel space, where the upfront costs of booking a holiday can be steep.

5 Deferred payments also help consumers better manage their cash flow 6 and budget 7 and increase the likelihood of the consumer coming back. One of the biggest selling points of BNPL is that it empowers consumers with the flexibility to repay according to their financial means. How can BNPL help the travel sector reap these benefits? Read on to find out.Ĭonsumers enjoy flexible payments for quality purchases The result: potential upticks in successful conversions, an increase in repeat consumers, and ultimately, revenue gains. More and more travel operators including airlines, hotels and holiday cruises are integrating BNPL as an online payment method for consumers. 2 Travel has also become a popular avenue for BNPL purchases. Between 20, BNPL usage boomed 85% globally 1, as more and more users tried deferred payment method for their online purchases, especially big-ticket buys like electronics. Buy now, pay later (BNPL) has become a mainstream online retail payment option in the past couple of years, and its growth shows little signs of slowing.

0 kommentar(er)

0 kommentar(er)